St. Martin businesses enjoy some of the lowest tax rates in Louisiana!

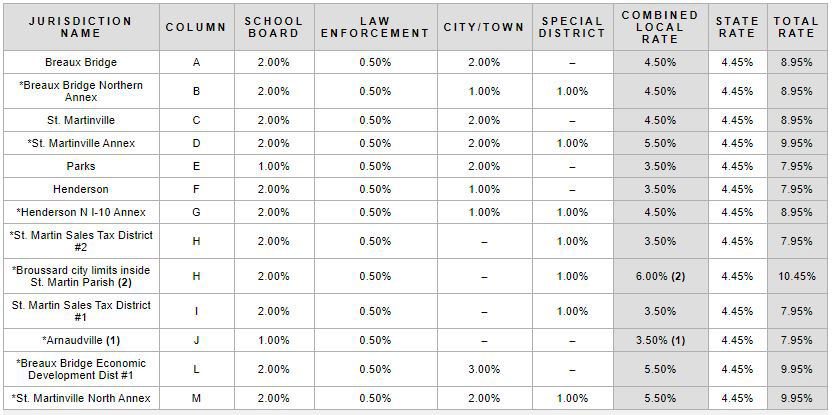

Businesses initially benefit from the fact there is no state property tax in Louisiana. Additionally, St. Martin Parish has no sales tax at the county level, but the state sales tax rate of 4.45% does apply. While some cities and local governments can charge sales tax, the Parish’s maximum sales tax rate of 8.95% is lower than 89% of other Louisiana counties, per the Sales Tax Handbook. In fact, according to the Tax Foundation, Louisiana’s combined 2021 average state and local sales tax rate of 9.52% ranks third in the country!

Louisiana’s combined 2021 average state and local sales tax rate of 9.52% ranks third in the country!

In addition, Louisiana’s tax forecast is very favorable thanks to legislator actions in 2021 that seek to reduce individual and corporate income tax rates. A series of bills will be voted on in 2021 that will result in significant pro-growth tax reforms if passed by voters.

Taxes are only part of the picture, however. KPMG’s Competitive Alternatives ranked Louisiana as the state with the overall business costs in the country in 2016. This takes into account taxes, labor costs, facility costs, utilities and transportation.